Economists and other housing experts predict the market will be more balanced among buyers and sellers. Home prices won’t change much while mortgage interest rates will continue to dip

While the slowing housing market has some expecting a crash in 2023, next year will likely be more humdrum, albeit still painful as the market continues to cool before an expected uptick in 2024, according to economic experts across the real estate industry.

In general, experts predict a more balanced market between homebuyers and sellers where home prices will either flatten, dip slightly or rise slightly while mortgage interest rates continue to decrease after a rapid rise this year and inventory bumps up marginally but not enough to make up for affordability challenges.

“The housing market has been running at a frenzied pace for the past two-and-a-half years, but the reckoning is at hand,” said Lisa Sturtevant, chief economist for Bright MLS, in a 2023 U.S. housing market outlook.

“In the second half of 2022, high home prices and fast-rising mortgage rates stalled market activity. As demand dries up and price expectations are re-set, home prices in most local markets will be dropping from their pandemic peaks.”

According to Taylor Marr, deputy chief economist at Redfin, continued high mortgage rates are likely to make the 2023 housing market the slowest since 2011.

“We expect home sales to sink to their lowest level in more than a decade in 2023 as high mortgage rates keep housing costs up and prevent people from moving,” Marr said in a report outlining Redfin’s 2023 predictions.

“High homeowner equity and a resilient job market will stave off a wave of foreclosures.”

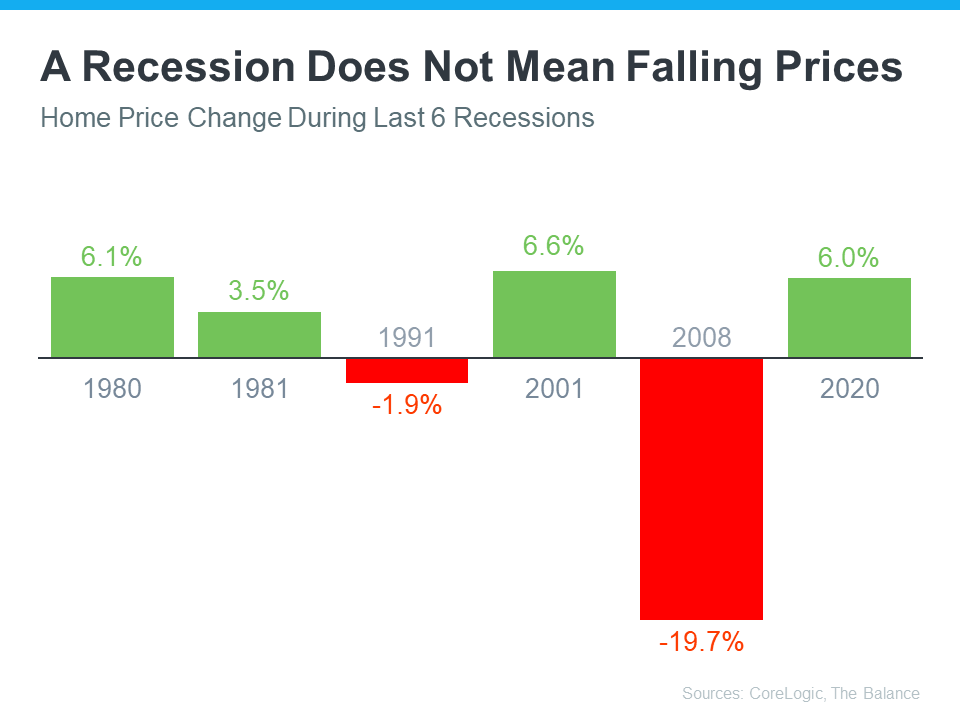

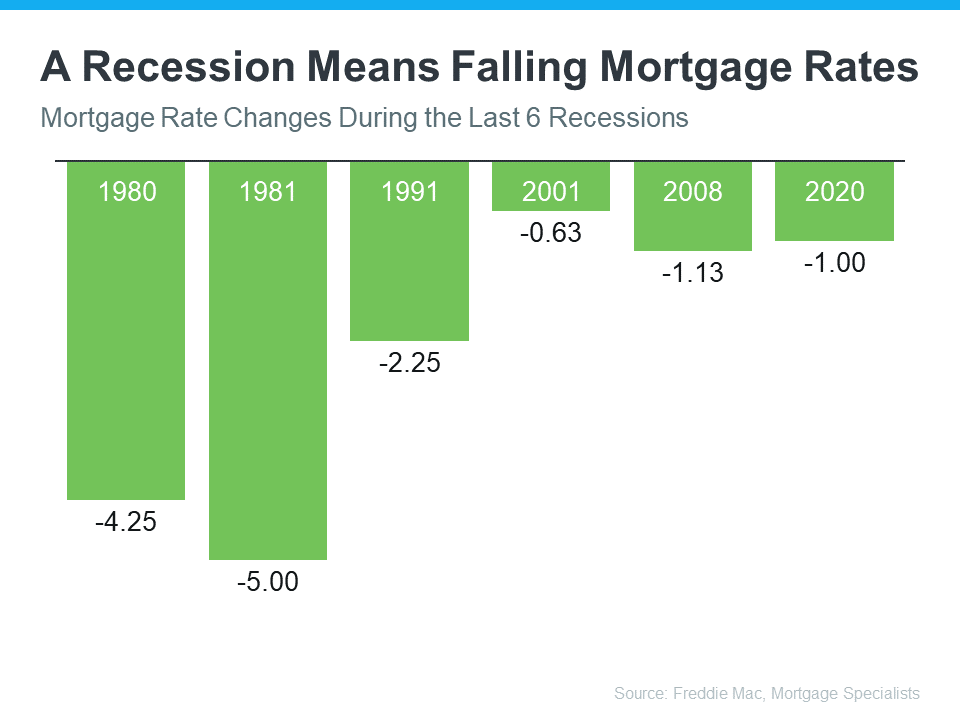

Fannie Mae is expecting a “modest recession” in 2023 with a predicted negative 0.5 percent in GDP growth before the economy expands by 2.2 percent in 2024.

“The economy caught its breath in the second half of 2022, but that doesn’t change our expectation that it will run out of air in early 2023 via a mild recession,” said Doug Duncan, senior vice president and chief economist at Fannie Mae in a statement.

“We expect housing to continue to slow, even though mortgage rates have come down recently. Home purchases remain unaffordable for many due to the rapid rise in rates over the last year and the fact that house prices, though certainly slowing and in some places declining, remain elevated compared to pre-pandemic levels.

“Of course, refinancing is still not practical for the vast majority of current mortgage holders, which we expect will also continue to constrain mortgage origination activity.”

Danielle Hale, chief economist for Realtor.com, anticipates that everyone in the housing market — sellers, buyers, and renters — “may be underwhelmed” next year in what she called a “nobody’s-market” friendly to neither buyers nor sellers.

“The slowdown in home sales transactions that began as mortgage rates surged in 2022 is expected to continue, leading to a moderation in home price growth and tipping housing market balance away from sellers,” Hale said.

“But with mortgage rates continuing to climb as the Fed navigates the economy to a soft-ish landing, a moderation in home price growth will not be enough for the housing market to be a buyer’s bonanza. Instead, home shoppers will enjoy advantages such as a growing number of homes for sale, but costs will remain high, challenging affordability at a time when overall budgets continue to be squeezed.”

Here are five economic indicators to keep an eye on next year.

Mortgage rates

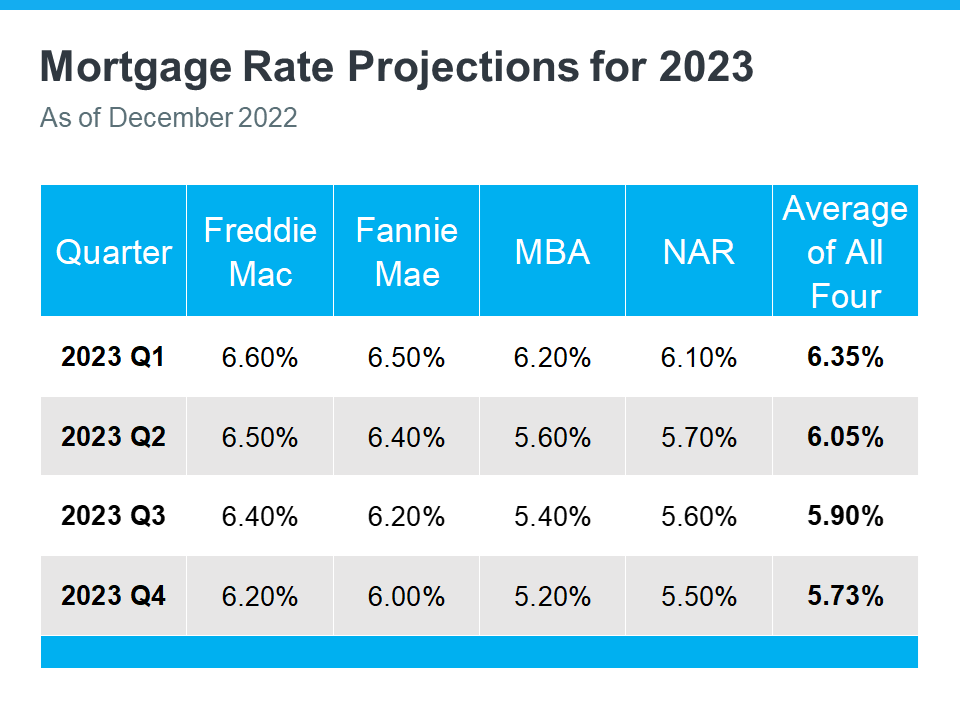

After starting the year at 3.2 percent, the 30-year fixed mortgage rate rose higher than 7 percent in October for the first time in more than two decades but has begun to decline. Experts differed on how much lower they expect the rate to fall in 2023.

Lawrence Yun, chief economist for the National Association of Realtors, expects the rate to settle at 5.7 percent as the Federal Reserve slows the pace of rate hikes to control inflation, lower than the pre-pandemic historical rate of 8 percent, according to an announcement from the 1.6-million-member trade group.

Similarly, Matthew Gardner, chief economist for Windermere, predicts rates will stay above 6 percent until the fall of 2023 and then “dip into the high 5 percent range,” which he noted was “still more than 2 percent lower than the historic average.”

Sturtevant predicted the rate would fall to 6 percent by the end of 2023 — much higher than in recent years but similar to the rate back before the Great Recession.

“Rising mortgage rates have been the main cause of the pullback in sales,” Sturtevant said. “The average rate for a 30-year fixed-rate mortgage will end 2022 around 6.5 percent after surpassing 7 percent earlier this fall. Mortgage rates will fall in 2023, but they will not come down nearly as quickly as they rose. Mortgage rates may have ended their steady upward rise, but expect volatility in rates throughout the rest of the winter before they begin to ease.”

Marr anticipates that the rate will end 2023 at around 5.8 percent, averaging about 6.1 percent for the year. That will make buying a home slightly more affordable than currently, but much less affordable than last year.

“Mortgage rates dipping from around 6.5 percent to 5.8 percent would save a homebuyer purchasing a $400,000 home about $150 on their monthly mortgage payment,” Marr said.

“To look at it another way, a homebuyer on a $2,500 monthly budget can afford a $383,750 home with a 6.5 percent rate; that same buyer could afford a $406,250 home with a 5.8 percent rate. Still, that’s much less affordable than a few years earlier. With a 3 percent rate, which was common in 2020 and 2021, that same buyer could afford a $517,000 home.”

Zillow’s research team predicted the affordability challenges that come with higher rates would mean more buyers will purchase homes with friends and family and more homeowners will become first-time landlords next year as they hold onto investment properties previously bought with record-low mortgage rates.

“A Zillow survey fielded this spring found that among successful recent homebuyers, 18 percent had purchased along with a friend or relative who wasn’t their spouse or partner, and 19 percent of prospective homebuyers intended to buy with a friend or relative in the next 12 months,” Zillow’s research team wrote in a report outlining its 2023 predictions.

“For both groups, affordability and qualifying for a mortgage were cited as the top reasons for buying together — challenges that are now even more acute. Mortgage payments for a typical U.S. home rose from needing 27 percent of median household income in January to 30 percent in March to 37 percent in October – far beyond the 30 percent threshold where housing becomes a financial burden.”

Home sales

While economists from Zillow and realtor.com predicted that existing-home sales would hit 16-year highs in 2022, sales actually dipped by 16.2 percent year over year, according to Yun. (Yun expected that sales would dip from 6 million in 2021 to 5.9 million in 2022, though sales fell further to 5.13 million). In 2023, Yun anticipates existing-home sales will decline 6.8 percent, to 4.78 million.

Sturtevant expects home sales will be lower in 2023 than in 2022 due to homebuyers purchasing homes earlier than planned when mortgage rates were low and to inventory remaining very low as homeowners decide to sit on lower mortgage rates. Existing-home sales are likely to reach 5.2 million by the end of the year, according to Sturtevant.

“While this is a decline of 15.1 percent from 2021, it is in line with the typical number of annual home sales prior to the pandemic,” she said.

“Overall, our forecasts are for there to be 4.87 million home sales nationally [in 2023], the first time the number of annual sales of existing homes falls below 5 million since 2014. Sales are projected to be down 6.4 percent from 2022 sales.”

Marr anticipates that home sales will fall to their lowest level since 2011 with a slow recovery in the second half of the year.

“We expect about 16% fewer existing home sales in 2023 than 2022, landing at 4.3 million, with would-be buyers pressing pause due mostly to affordability challenges including high mortgage rates, still-high home prices, persistent inflation and a potential recession,” he said.

“People will only move if they need to. That’s fewer home sales than any year since 2011, when the U.S. was reeling from the subprime mortgage crisis, and a 30 percent decline from 2021 during the pandemic homebuying boom.”

Hale predicts 2022 existing-home sales to add up to about 5.3 million, down 13.8 percent from 2021, and to decrease another 14.1 percent in 2023 to 4.5 million.

“The deceleration in home sales is likely to continue as high home prices and mortgage rates limit the pool of eligible home buyers,” she said.

Inventory

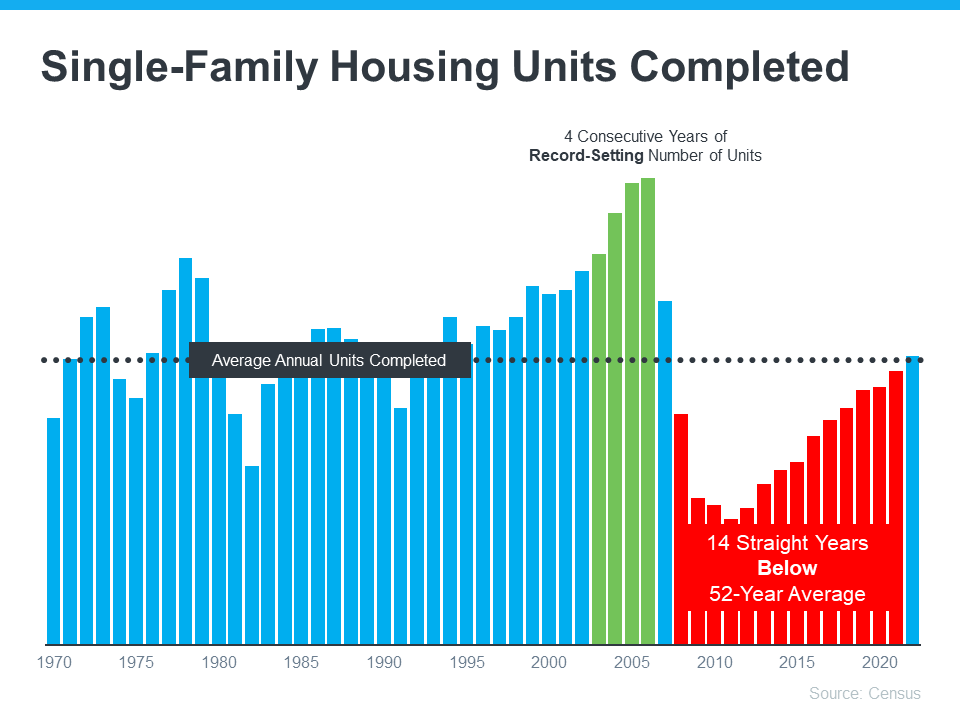

The for-sale housing supply is at historically low levels and likely to remain so even as inventory rises slightly in 2023 and new construction is focused on multifamily rentals, experts predict.

“Although inventory levels rose in 2022, they are still well below their long-term average,” Gardner said.

“In 2023, I don’t expect a significant increase in the number of homes for sale, as many homeowners do not want to lose their low mortgage rate. In fact, I estimate that 25 million to 30 million homeowners have mortgage rates around 3 percent or lower.

“Of course, homes will be listed for sale for the usual reasons of career changes, death and divorce, but the 2023 market will not have the normal turnover in housing that we have seen in recent years.”

Gardner does not expect a buyer’s market in 2023 but does expect a more balanced one.

“A buyer’s market is usually defined as having more than six months of available inventory, and the last time we reached that level was in 2012 when we were recovering from the housing bubble,” he said.

“To get to six months of inventory, we would have to reach 2 million listings, which hasn’t happened since 2015. In addition, monthly sales would have to drop to below 325,000, a number we haven’t seen in over a decade.”

Hale predicts that inventory levels will continue to grow gradually — by 4 percent in 202 and by 22.8 percent in 2023 — as the turnover of homes slows. That still puts inventory lower than in 2019.

“The level of inventory in 2023 is expected to fall roughly 15 percent short of the 2019 average,” Hale said. “In fact October 2022 was the first time that inventory climbed back to its 2020 level for the same time of year.”

Marr anticipates that building permits and housing starts will drop about 25 percent annually in 2023 with most of the pullback in single-family homes.

“Construction of single-family homes surged during the pandemic, which means builders need to offload the homes they have on hand without adding more supply to limit their financial losses,” Marr said.

“They’ll pull back dramatically in some markets like Phoenix and Dallas, where they built too many homes in anticipation of demand that’s failing to materialize.”

While he expects that rental building activity will fall slightly next year, he doesn’t expect it to fall as much as the construction of single-family homes.

“Constructing rental units, including apartment buildings and multifamily houses, will make more financial sense for builders next year, as rental demand won’t fall off as much,” he said.

“Some construction spending will shift to remodels, as many Americans hoping to move will instead opt to renovate in the face of high mortgage rates.”

Home prices

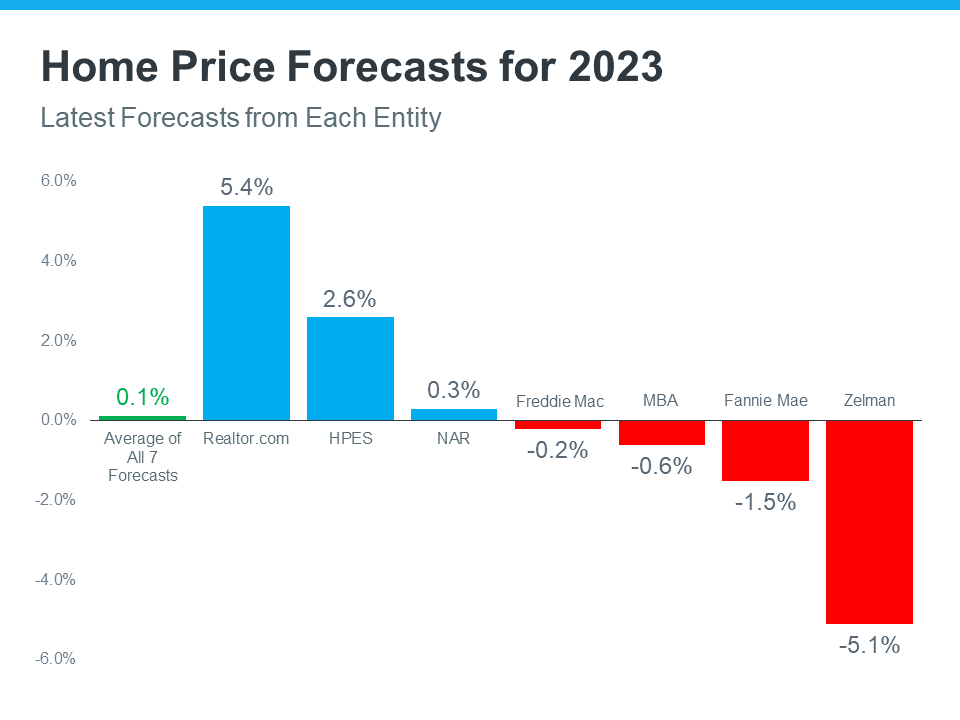

After rising by double-digits in 2021 — 16.9 percent, according to Yun — home prices nationwide are expected to end 2022 nearly 10 percent higher. Yun predicts a 9.6 percent jump this year while Sturtevant predicts a 9.5 percent jump. Experts’ forecasts on prices in 2023 vary from those thinking prices will remain flat to those expecting single-digit rises or dips.

“Home prices will be relatively stable in 2023, with the median price rising by just 0.3 percent,” Sturtevant said. “Stable prices nationally will be supported by relatively low inventory in 2023.”

Yun also expects median home prices to rise 0.3 percent to $385,800.

“The probability of a price crash is essentially very small given the lack of supply,” he said during a forecast webinar earlier this month.

“Half of the country may experience small price gains, while the other half may see slight price declines,” Yun added. “However, markets in California may be the exception, with San Francisco, for example, likely to register price drops of 10–15 percent.”

At the same time, Hale anticipates home prices to continue to grow, though at a slower pace than in recent years, further eroding home affordability.

“Soaring prices were propelled by all-time low mortgage rates which are a thing of the past,” Hale said. “As a result, home price growth is expected to continue slowing, dipping below its pre-pandemic average to 5.4 percent for 2023, as a whole.

“As higher mortgage rates cut into homebuyer purchasing power, the monthly cost of financing the typical for-sale home will average more than $2,430 in 2023. This would be a nearly 28 percent increase over the mortgage payment in 2022, and roughly double the typical payment for buyers in 2021.”

Meanwhile, Marr predicts that home prices will post their first year-over-year decline in a decade in 2023, dropping about 4 percent to $368,000.

“That’s due to elevated rates and final sale prices starting to reflect homes that went under contract in late 2022,” he said.

“Prices would fall more if not for a lack of homes for sale: We expect new listings to continue declining through most of next year, keeping total inventory near historic lows and preventing prices from plummeting.”

Still, the country will avoid a wave of foreclosures, according to Marr.

“Very few homeowners are likely to see their mortgages fall underwater even with next year’s anticipated price declines,” he said.

“That’s because the homeowners who’ve had their home for at least a few years have fixed low mortgage payments and plentiful home equity after values skyrocketed during the pandemic. Even those who bought recently near the height of the market are likely to have made a sizable down payment and therefore have some equity to land on.

“Importantly, the jobs market remains resilient; even if there is a recession, economists expect a mild one with a small increase in unemployment, so it’s unlikely that many homeowners will fall behind on their mortgage payments.”

In response to some predictions that the market will crash next year because it’s in a bubble, Gardner was blunt: “There is no housing bubble.”

“Over the past couple of years, home prices got ahead of themselves due to a perfect storm of massive pandemic-induced demand and historically low mortgage rates,” he said.

“While I expect year-over-year price declines in 2023, I don’t believe there will be a systemic drop in home values. Furthermore, as financing costs start to pull back in 2023, I expect that will allow prices to resume their long-term average pace of growth.”

Gardner expects that affordability will continue to be a major problem for homebuyers due to relatively high mortgage rates, though Zillow’s research team expects affordability to stabilize, if not improve, in 2023.

“Zillow expects national home values to remain relatively flat next year, and even fall in the most affordability-challenged markets,” the research team said.

“Mortgage rates, highly impactful to the mortgage payment, are seeing some recent and encouraging progress downwards as inflation and labor market tightness show small signs of easing, enough to lead some to suggest the Federal Reserve may ease its aggressive monetary contraction. If we’ve actually turned the corner on inflation, that should continue.”

Variable markets

While home prices are not expected to change much overall next year, individual markets may fair differently. Experts generally predicted that relatively affordable Midwestern markets are likely to be strongest next year.

“Unlike nearly every other region in the United States, prices in most Midwest metro areas haven’t run up to extremes,” Zillow’s research team said.

“Mortgage costs as a share of income are still within healthy, sub-30 percent levels across Ohio, Pennsylvania, Kansas, upstate New York, Iowa and smaller metros in Illinois, which will allow first-time buyers to take the plunge. Lower rents and home prices in these areas make it easier to save up for a down payment.

“Having available houses to choose from is another key component of a healthy market, and the Midwest stands out — inventory isn’t in a massive hole compared to pre-pandemic times, and declines in new listings are smaller than the national average, encouraged by the more consistent demand from buyers.”

Meanwhile, markets with big run-ups in prices during the pandemic are likely to see the steepest declines, according to economists.

“Nationally, the median home price increased by an average of 10 percent annually between 2019 and 2022,” Sturtevant said.

“As remarkable as the national price growth has been, there are some metro areas where median asking prices grew even faster. These markets are among those at greatest risk of a significant price correction. Metro areas with the fastest three-year price appreciation include Austin (+53 percent), Tampa (+52 percent), and Miami (+50 percent).”

Bright’s forecast predicts that metro areas where price appreciation increased the fastest, where inventory has increased quickly, where sellers are dropping list prices, where affordability is a bigger challenge and where the labor market is weaker are likely to see significant price declines. The MLS singled out these metros in particular as fitting this criteria: Las Vegas, Nevada; Riverside-San Bernardino, California; Phoenix, Arizona; Austin, Texas; and Los Angeles, California.

For similar reasons, Redfin expects these markets to hold up best in 2023:

- Lake County, Illinois

- Chicago, Illinois

- Milwaukee, Wisconsin

- Albany, New York

- Baltimore, Maryland

- Elgin, Illinois

- Rochester, New York

- Pittsburgh, Pennsylvania

- New Haven, Connecticut

- Hartford, Connecticut

“Measures of homebuyer demand and competition in these metros are nearly as strong as they were in the beginning of 2022,” Marr said.

“On the other end of the spectrum, we expect prices to fall most in pandemic migration hotspots like Austin, Boise and Phoenix, largely because the huge increases over the last two years leave a lot of room for prices to decline.

“Expensive West Coast cities are also likely to see outsized price declines because of stumbling tech stocks and the shift to remote work pushing so many people out of those markets.”

Gardner agreed that markets where home price growth rose the fastest recently will likely see the biggest price declines, but that “even those markets will start to see prices stabilize by the end of 2023 and resume a more reasonable pace of price growth.”

*Inman, 12/28/22, Andrea V. Brambila.